Car Accident Settlement Guide

Car Accident Settlements: Everything You Need to Know

Car accidents are stressful. Even when you’re not at fault, the aftermath of a collision on the road can be trying. Whether you’ve suffered serious injuries, damage to your vehicle, or psychological trauma, it’s easy to feel overwhelmed. Often, there needs to be a discussion about a car accident settlement.

- How Much Is Your Car Accident Settlement Worth?

Find out the maximum compensation you could receive.

- How Much Is My Car Accident Settlement Worth?

Here is our comprehensive guide to Car Accident Settlements. We aim to help you:

- Determine what damages can be included in your auto accident settlement.

- Collect and document evidence in your favor.

- Acknowledge any contributory negligence.

- Understand the ways in which insurance companies frequently negotiate down car accident settlements.

- Learn about average car accident settlements by injury, car accident type, and more.

While conversations with insurance claims adjusters may seem difficult, it’s important not to back down on what you feel you’re owed. They say knowledge is power, and that’s especially true when your health, safety, and finances are on the line. It may be tempting to take the first offer that an insurance company sends your way. Do so, and you’ll likely never be able to pursue a personal injury claim for the damages you suffered ever again.

By understanding the Car Accident Settlement process, you’ll prevent this kind of mistake and ensure your damages are covered. Whether you take on the insurance company with an injury attorney or by yourself, it pays to know what you’re up against.

How Can I Maximize My Car Accident Settlement?

The day after a car accident can be nearly as shocking as the collision itself. Depending on the severity of the crash, you may awaken to broken bones, contusions, damage to your car and more. While the previous day might have felt like a bad dream, awakening the morning after can feel like you’re stuck in a nightmare.

Insurance companies know how stressful the days and weeks following a wreck can be for people, and they use this knowledge to their benefit. When all you want is for things to go back to normal, the insurance company may offer up what feels like relief on a silver platter. It may be incredibly tempting, but we urge all accident victims to give the car accident settlement a second glance before accepting.

Here are a few key points to remember on the road to ensuring a fair auto accident settlement:

Take Pictures

It is always wise to take photographs of the scene of the car accident and your injuries. If you can, take pictures of where the cars ended up after the crash, as well as the damages to both cars at the scene.

Good photographs are an excellent piece of evidence that your lawyer can use in negotiating a better car accident settlement. If the case goes to trial, having good photographs will act as a strong visual for the jury.

Reaching Maximum Medical Improvement

Once you’ve signed for a cash settlement for a car accident, you’ll never again be able to pursue compensation for your damages. This can be problematic because with some injuries, you may not even realize the full extent of your injuries before you’re offered a car accident settlement. While it’s reasonable to want to settle and put the whole thing behind you, taking the first offer extended to you isn’t always the best course of action. Most attorneys will advise you to wait until you’ve reached something called Maximum Medical Improvement, or MMI, before accepting a car accident settlement offer.

Should you sustain a traumatic brain injury in the wreck, for example, you’ll want to take your time healing. It can take many months to see specialists, have surgery, take medication and get physical therapy before you have a true idea of what a life post-accident will cost. While it’s impossible to predict the future, you’ll have a much clearer picture once the dust of the collision has settled.

Maintain Accurate Records

If you were in a collision it is important to keep accurate records of the accident. You need to collect police reports. Also important are your medical treatment documents and witness statements.

The other driver’s auto insurance company will try to collect information to use against you. This would leave you at a major disadvantage if you failed to keep correct documentation.

When you hire your lawyer, she will finish this key investigation for you. Your lawyer will gather and present all necessary records when you go to settlement.

Get A Good Personal Injury Attorney

After an auto accident resulting in injuries, it is important to immediately get in touch with a good personal injury attorney. Also, never speak to the other person’s auto insurance company until you have an attorney. If you say the wrong thing to the claims adjuster, you could end up losing much of the compensation you deserve.

A skilled auto accident attorney will handle the complex negotiations with insurance adjusters, ensuring that you receive a fair car accident settlement. Insurance companies are notorious for making lowball introductory offers to victims without legal representation, knowing there’s a good chance the person will accept because they don’t know any better. Don’t make this costly mistake – especially when most car accident lawyers offer free consultations and don’t charge out of pocket fees.

- Speak to a Car Accident Attorney

- Fast, Free & Confidential!

File the Auto Accident Claim Quickly

Every state has a statute of limitations for when you can file a car accident claim. This can range from one to four years from the date of the accident. But the sooner you file the better. Some of the strength of your claim could be from the testimony of witnesses. The sooner that you get the case filed with the evidence fresh, the more likely you can get a good car accident settlement.

You also should give your attorney plenty of time to build your case.

Create a Demand Letter

Once you have a good idea of what your accident has cost you, it’s time to create a car accident settlement demand letter. Typically, this kind of document is created by an experienced car accident attorney. It represents the best chance – outside of a courtroom – for a victim to advocate for themselves. Demand letters allow you to set the stage for negotiations.

In the letter, you’ll outline the precise events immediately before, during and after the accident. You’ll want to point out the mistakes made by the at-fault driver, any actions you tried to use in preventing a collision, and a detailed account of the crash itself. Then, you’ll list out your damages, including medical bills and lost wages. An attorney can recommend the best place to begin negotiations; in many cases, the first figure offered by a car accident lawyer is much higher than is reasonably expected for the settlement. Starting high allows room for negotiation.

Negotiate a Car Accident Settlement Offer

Don’t be surprised if your initial demands are met with a lowball offer. Insurance companies exist, first and foremost, to create profits for shareholders. They will do everything they can to save money paying out claims and settlements. Thankfully, a good lawyer will be skilled in negotiation and help you get the largest settlement possible.

While there may be some back and forth during this process, it’s important to be patient. Should negotiations stall, you may want to seek additional evidence of the impact your injuries have had on your life. A letter from a doctor or photos of your injuries may bolster your argument. A polite response with additional evidence advocating for why additional compensation is needed can go a long way!

Accept the Offer – Or Go to Court

In most cases, auto accident victims and insurance companies find a number they can agree upon and settle out of court. Before signing any kind of settlement offer, be sure to go over your medical bills and be sure that the settlement will cover them, along with any future costs you might incur in your continued recovery. Make sure the offer is large enough for you to pay for attorney’s fees and any wages you lost out on because of the wreck.

Should you fail to reach an agreement, you’ll need to escalate your claim and file a car accident lawsuit. In many cases, negotiations continue all the way up until the day of court. In most cases, insurance companies will do all they can to prevent a lawsuit. It behooves both parties to come to a mutual agreement about compensation. While you can certainly have your day in court if necessary, you risk a judge ruling in favor of the insurance company. Only an accident lawyer familiar with your case can recommend whether or not to accept a settlement offer.

After collecting the contact information of the other driver and seeking medical attention, it can be difficult to know where to turn for justice and the car accident compensation you deserve. An offer letter detailing how much your car accident settlement is worth may help clarify your situation.

Even with money on the table it can be difficult to know if you’re being treated justly. Many times, insurance adjusters will lowball accident victims, offering them far less in the initial car accident settlement offer than what they deserve. These companies know that many car wreck victims are unfamiliar with the negotiation process that comes after a wreck, and will try their best to take advantage of this.

- How Much Is Your Car Accident Settlement Worth?

Find out the maximum compensation you could receive.

- How Much Is My Car Accident Settlement Worth?

Most Common Mistakes During an Auto Accident Settlement

People respond to traumatic events in a variety of ways. Some people compartmentalize and handle decision-making in a logical way. Others go into survival mode. When your adrenaline is pumping, it can be difficult to make smart choices. Even after a traumatic car crash, victims can feel paralyzed by their options. This can often lead to errors that lower the car accident settlement offer in the end.

The days and weeks following a car accident can be overwhelming for even the most cool-headed of people. If you’re hoping to avoid many of these common post-accident mistakes, follow this guide.

Admitting Fault

The first thing to remember is to not say anything at the accident scene that will negatively affect a claim later. This is generally called ‘admissions against interest.’ They are unsolicited statements made by a plaintiff. Some of the most common admissions that people make in the wake of an accident are:

- Sorry, I did not see you.

- I was on the phone, or I was texting.

- I was talking to someone in the car.

- My tires are old and I could not stop in time.

- I just looked down to change the radio station.

- I am not injured.

Any of these statements can lead to very serious problems when you and your attorney are negotiating a car accident settlement with the insurance company.

Another one that can trip you up is if the insurance adjuster for the other party calls you. Even if you just say ‘I am fine’ after she asks ‘how are you?’, this can damage your claim.

Skipping a Medical Exam

When you’re involved in a crash, it’s tempting to do anything in your power to put it behind you. After all, car wrecks are stressful. If you don’t notice an injury immediately after a collision, you may consider skipping out on a medical exam. If you’ve declined medical care, you could be making a big mistake.

The human body responds to trauma in curious ways. Many crash victims don’t realize they have suffered an injury until after they’ve left the scene of the crash. In some cases, it may take weeks for the body to show signs of common accident injuries like whiplash. Not seeking medical attention could result in difficulty connecting your injury to your accident.

For this reason, it’s important to get checked out after a crash even if you don’t think you’re hurt. The better you document your injuries, prognosis, and treatment, the more likely you’ll receive compensation. Early examinations can also help mitigate the impact the injury has on your overall health.

Forgetting to Collect Evidence

It can be difficult to remember the steps necessary to maximize your car accident settlement after the crash. Failure to collect vital evidence can limit the settlement amount. Of course, medical attention should take priority over evidence collection. After clearance by the paramedics, though, it’s important to take action.

You will need the contact and insurance information of the other driver involved. Also, be sure to collect official report details from the police officer on scene. Snap a few photos of the damage, your injuries, and the intersection where the incident occurred. If witnesses observed the crash, write down their names and contact information, too. By gathering initial evidence, you have a head start for your lawyer’s investigation.

Posting About Your Accident on Social Media

If the idea that your social media is being scrutinized by people you don’t know troubles you, you may need further insight on what not to do online following your accident. The truth is, insurance adjusters will look at your social media profiles, and what you post on social media about your car accident can and will be used against you. In many cases, your first instinct might be to delete your profiles altogether, but that tops the list of what not to do following an accident. Consider how deleting your online presence looks to investigators: you’ll likely come off as trying to hide something, which only encourages them to dig deeper into your personal life. Instead, take a break from social media while you’re sorting out your accident claim. This should extend to your presence on your friends’ feeds, too. Ask them not to post any photos of you or tag you in posts mentioning your presence at events or activities. In short, minimize your appearance online across your profiles and the profiles of your friends.

If you opt not to take a complete break from social media, resist the urge to post about the accident altogether. While you may see your social media accounts as your way to stay connected with friends and family and loop them in on your major life changes, writing publicly about your experiences may come back to haunt you in court. Statements made online can be used as admissions and used to argue against your claims. For example, if you mention online that you were distracted by the radio at the time of the wreck, the defense could argue that you contributed to the accident by your negligence.

Even if you’re careful not to post about the accident on Facebook or Twitter, your presence on review sites like Yelp could be scrutinized by investigators. A review of a go-kart track a week after your wreck could cast doubt on the severity of your injuries, and reviews of a restaurant that mentions celebrating a friend’s birthday could be used as evidence that you’re not as emotionally impacted by your collision as you said you were.

Trusting the Insurance Company

It’s tempting to take the insurance company’s word when they say they’ll take care of everything. After all, you pay monthly premiums for this exact situation, right? While it’s easy to sit back and trust that the insurance company has your best interests at heart, it’s a mistake to do so. Insurers work to turn a profit. They’ll do everything they can to get out of paying accident victims what they’re owed.

While it’s important to be polite when working with a claims adjuster, it’s also important to be your own advocate. Talk to a car accident lawyer about what your claim is worth. Don’t be afraid to reject lowball offers from the insurance company. Even if they try to make their offer out to be significant, it’s worth doing your research.

Any phone call the insurance adjuster has with you will be recorded unless you say no. You should not allow the phone call to be recorded unless your attorney is on the phone with you. A recorded statement will set the limits for the case going forward, and this is not a good idea. Only the insurance company benefits from the recorded statement.

Every insurance adjuster has been trained to get you to talk informally and to take down your guard. They attempt to get you to relax so that you will say things that harm the case. If you are too relaxed, it is much easier for the adjuster to get admissions out of you.

When you are first talking to the adjuster about the accident, all you should talk about are the facts, such as when/where of the crash; your contact information and personal details; and location of your vehicle.

You only should get into more detailed facts of the case later, and ideally when you are represented by an attorney.

Settling Quickly

Often, accident victims are more concerned with when they will receive their settlement, rather than how much it will be. Car wrecks can be expensive, after all. You may be facing expensive repair and hospital bills. You may question how you’ll ever be able to afford the unexpected upfront costs associated with the wreck. It’s difficult to resist taking the first settlement offered.

An insurance company will rarely offer their best settlement up front. Even if you’re in a tough financial spot, focus on the big picture of negotiation. If you’re serious about getting a fair offer, patience is key. Take time to build your case, and you’re more likely to see a higher car accident settlement offer.

No matter the circumstances surrounding your auto accident settlement, it’s worth talking to an attorney about your legal options.

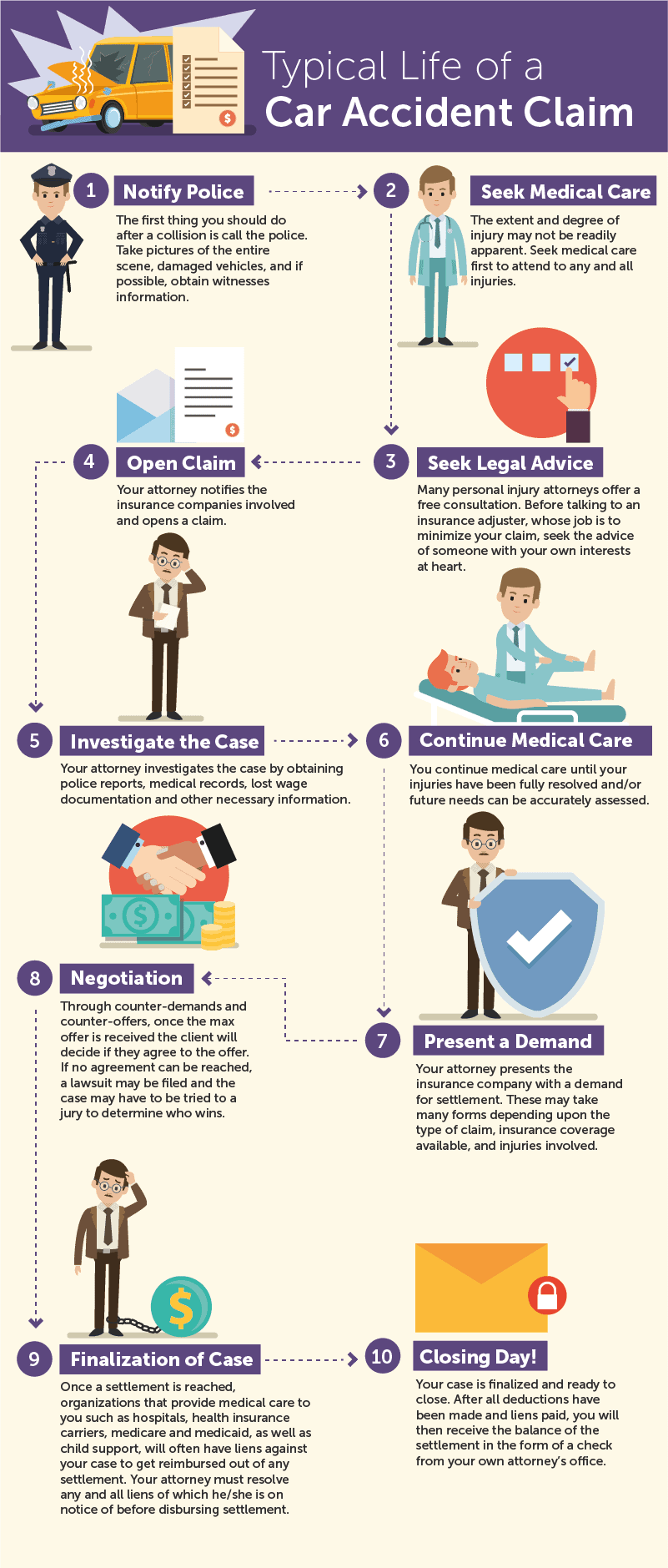

What is a Typical Car Accident Settlement Timeline?

Most accident cases never go to trial and resolve through the car accident settlement process. Only a small percentage of car crash cases go to court for trial. This is because most car accident claims resolve with a settlement.

How long the case will take to settle depends on many things, including these factors:

- Whether you hire a lawyer: Auto insurance companies prefer that accident victims handle the case themselves. They will usually offer a low-ball settlement right after they get the claim. The insurance company wants to settle it fast and for as little money as possible. Hiring an attorney will cause the negotiations to go longer but you are almost guaranteed more money.

- The facts of the case: If fault for the accident is clear, the insurance company for the at-fault driver will want to settle fast. But if there is any dispute about fault, you can expect negotiations to take much longer. There will need to be a complete investigation of the crash, and this could take months.

- Extent of your injuries: If you have suffered major injuries it could take much longer to settle the case. The insurance company will want to see detailed documentation of your injuries and treatments before they give you a settlement offer.

- The ability of the court to schedule a hearing and trial: If you go to court, the court’s calendar will affect the timing of your settlement. If the court backs up with cases, hearing and trial dates can get pushed back by months. These types of delays can lead to one party getting tired of waiting and a settlement may be offered or taken.

Much of the timing involved in settling an auto accident claim comes down to you. If you need money for medical bills, lost wages, etc., you may decide to take less money with a quick settlement. There are cases where the at-fault insurance company can make a low-ball offer in a matter of days or a week or two. But you should be cautious about taking a low offer if you have more than minor injuries. Once you have signed the release waiver with a settlement, you cannot seek more money later.

If you have more serious injuries, you should consider delaying the settlement. You could have injuries that affect you for months or years, and you may need more medical treatment. Contact a personal injury attorney, who will know whether it is advisable to take a lower settlement offer or try to get the more compensation for your auto accident injuries.

Should I Accept the Auto Accident Settlement Offer?

A car wreck can throw your life into chaos. It can be tempting to take the first offer the insurance company gives you and get back to your life. But before you accept a settlement offer, consider the following:

First, know that you can reject any settlement offer from the insurance company and still get compensation. Insurance companies like to tell you that their settlement offer is non-negotiable. An attorney can tell you that the first offer is the beginning of the negotiation process. Insurance companies want you to accept a settlement before hiring an attorney.

In most cases, you are wise to reject the first accident settlement offer. The company knows if the case goes to trial, they will likely pay more, so use that to your advantage.

- How Much Is Your Car Accident Settlement Worth?

Find out the maximum compensation you could receive.

- How Much Is My Car Accident Settlement Worth?

That is true even if you discover later that your injuries are far worse than you thought. You should not consider settling until you completely recover from the wreck.

Third, your injuries could be worse than they first appear. You might think that you only have a sore neck the day after the accident. But a week later, the pain has gotten worse. It could turn out you have a ruptured disc in your neck. Because you took the quick settlement, you are stuck with the extra expenses..

Before you accept a settlement, you should know how your injuries will affect your future. You also need to understand what level of ongoing care you will need because of the accident. Do not accept an offer before you reach maximum medical improvement (MMI), which only your doctor can determine.

Fourth, the total cost of your accident is more than your out-of-pocket expenses. Many offers only include money for repairs, immediate lost wages, and medical costs not covered by your health insurance. They rarely cover the full cost of your accident. There are many other things you could need compensation for:

- Vehicle repairs

- Hired services for duties in the house you cannot perform, such as shopping, cooking, cleaning up the yard, caring for children, etc.

- Medical costs in the future

- Lost earnings in the future

- Mental health treatment for serious accident trauma

- Pain and suffering

- Loss of enjoyment of life

Before you consider a car accident settlement offer it is important that you understand the value of everything that accident compensation should cover.

Settle the Claim or File a Lawsuit?

If you sustain an injury in a car crash, you may be thinking about filing a car accident lawsuit. It is possible that the courtroom is where the case ends up. That said, plaintiffs should know going in that most car accident injury claims result in a settlement before trial. Also, many accident insurance claims resolve via settlement before a lawsuit is filed.

Yet, there are cases where going to court is necessary, and there are advantages in doing so. There are various factors to consider before actually going through with a lawsuit.

Settling Before a Car Accident Lawsuit

Many injured parties will settle their claim before filing suit. Here is why you might want to consider this:

- You get paid faster

- You avoid paying attorney fees

- Avoid going to court; lawsuits may require several hearings

- You avoid relying on an unpredictable jury for compensation

- Going to court is not a guarantee of more money (or any money) in your pocket

The question you need to ask is this: Is it worth the risk of going to trial and getting nothing? It depends on what type of settlement offer you have in hand. If the insurance company is low-balling you or offers nothing, you may have no choice but to file a lawsuit.

Going to Court

It is usually best to try to settle your car accident claim out of court. But settlement may not be in the cards in your case. Here are the typical steps in the lawsuit process:

- Your attorney files your auto accident lawsuit in court by drafting a legal complaint and sending it to the court. You also have to serve the other driver using a police officer, sheriff or process server. The other driver has 20 days usually to answer.

- You next take part in the ‘discovery’ process. You will ask for information from the other driver and he will ask for information from you. Information is obtained by exchanging written documentation. Or, you can request that your attorney depose the other driver.

- Trial is the final stage of the car accident lawsuit process. During the trial, the judge or jury will hear all the evidence from both sides and render a decision. The time it takes to prepare and represent you at trial can accumulate very expensive legal fees. It is important that you be sure that it is worth going to trial to resolve your case.

Remember you can settle the case at any point during the lawsuit process. The other side may decide to up their settlement offer once they see you are willing to go to trial. The mere threat of a lawsuit going forward could be all you need to get the car accident settlement you want.

Did I Receive An Average Car Accident Settlement?

After a crash, you may decide to file a car accident claim or lawsuit against the other driver. Many people suffer injuries that leave them with medical bills and lost work time. But after you have gotten your settlement, you might wonder if you received an average or fair amount of compensation. How do you know?

The first thing to realize is the value of the claim is dependent on many factors. The average car accident settlement depends on things such as: how severe your injuries are, how long you need medical treatments and rehabilitation, required surgeries, physical damage to your vehicle, medical bills, lost earnings, and more.

How Car Accident Claims Are Valued

There is no one-size-fits-all way that insurance companies value car accident claims and injuries. A common tool insurance adjusters use is a multiplier. The adjuster will multiply your special damages by a certain number. Generally, special damages are your financial losses from the accident, such as hospital bills, doctor bills, lost wages, and costs to repair your car.

Many insurance companies will add up your special damages and then multiply it by a number from 1 to 5. The basis is how severe your pain and suffering is.

For example, assume the total of your medical costs and lost earnings from your accident is $10,000. If the insurance company multiplies your special damages by 2 then your claim is worth $20,000. If you had worse injuries and pain and suffering and the adjuster used a 4, your claim would be worth $40,000.

- How Much Is Your Car Accident Settlement Worth?

Find out the maximum compensation you could receive.

- How Much Is My Car Accident Settlement Worth?

Compensation For Pain and Suffering In Car Accident Settlements

On average, insurance companies will multiply your special damages by 2 or 3 to determine your settlement. How the insurance company determines your multiplier will be what determines if you got a fair car accident settlement.

For many auto accidents, injuries are minor to moderate and take minimal time to recover from. Those types of accidents are ones where a 2 or 3 multiplier may be appropriate. Car crashes with more severe injuries warrant a 4 or 5 multiplier.

But there is no simple answer for which multiplier the insurance company will use in a specific case. It depends on many things. Generally, lower medical bills and lost wages indicates that a 1-3 multiplier. If your medical costs are only a few hundred dollars, this suggests that your injuries resolved in one or two medical visits. If you only had one medical treatment, the insurance company might conclude that your pain and suffering was minor.

Yet, if your medical expenses were $50,000, the insurance company knows you were likely in the hospital and/or had many medical treatments. A hospital stay generally indicates more pain and suffering. In this case, a 4 or 5 multiplier might be applicable.

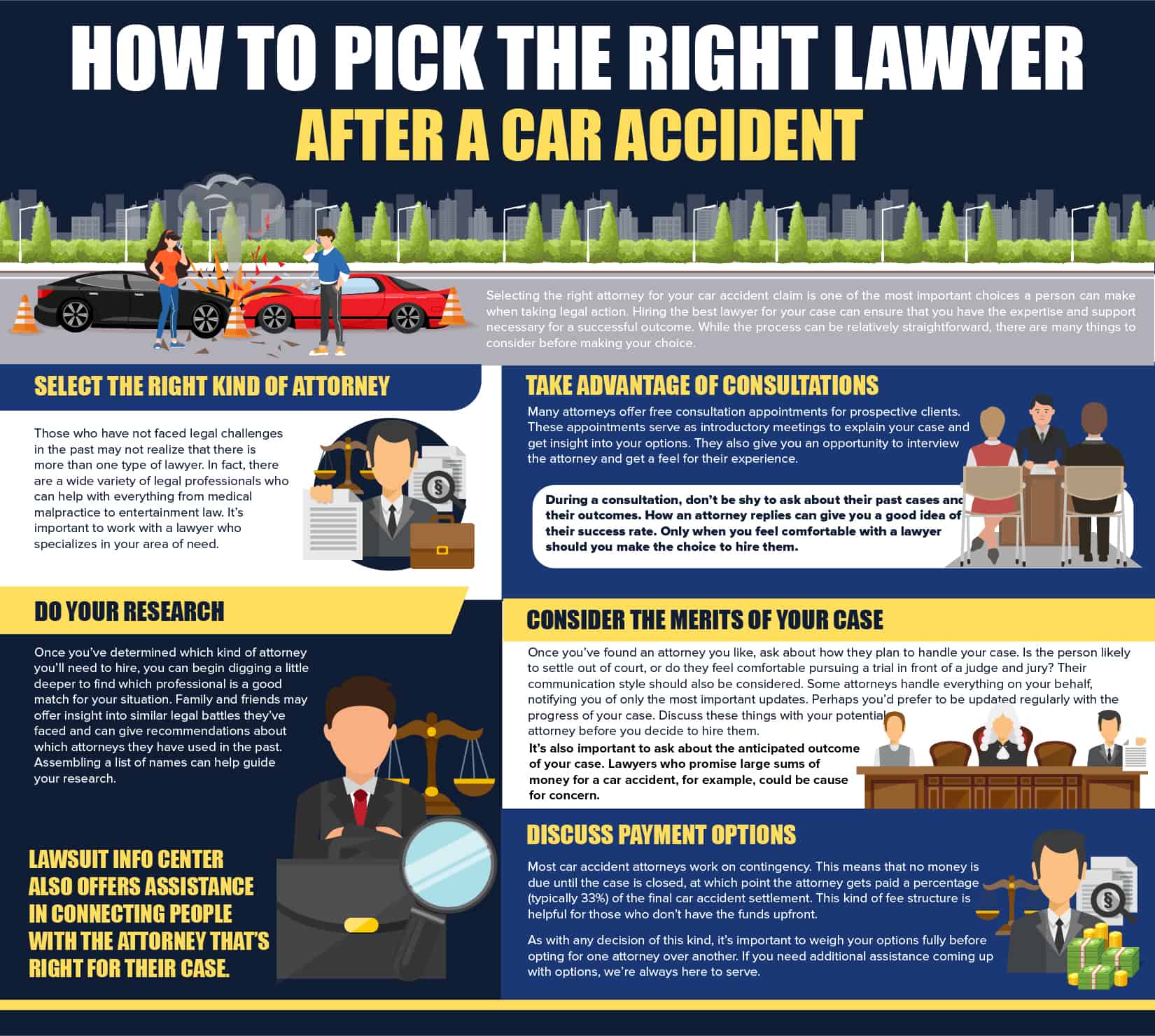

How to Pick the Right Lawyer after a Car Crash

Selecting the right attorney to handle your claim is an important part of the car accident settlement process. Hiring the best lawyer for your particular case can ensure a successful outcome. While the process can be straightforward, there are many things to consider. Here are a few guidelines to help you pick the right attorney for your car accident case:

Select the Right Kind of Attorney

Those who have not faced legal challenges in the past may not realize that there are a wide variety of legal professionals who can help with things ranging from medical malpractice to entertainment law. It’s important to work with a lawyer who specializes in your particular area of need. A consultation with a divorce lawyer won’t get you very far in your auto accident whiplash settlement.

In almost every car, truck, or motorcycle accident settlement you encounter, you’ll want to enlist the services of a Personal Injury Attorney.

Do Your Research

Once you’ve determined which kind of attorney you’ll need, you can decide on a professional who is a good match. Family and friends may give recommendations about attorneys they have used. Assembling a list of names can help guide your research. Once you’ve narrowed it down to the top few choices, here are a few key questions to ask:

- Do they have experience handling these specific claims? For example if I was rear ended by a semi truck, I’ll want to ask the attorney what experience he or she has in negotiating semi truck accident settlements.

- How long have they been practicing?

- How are their online reviews?

- Have they ever been suspended or disciplined by the bar association in their state?

Take Advantage of Consultations

Many attorneys offer free consultation appointments for prospective clients. These appointments serve as introductory meetings to explain your case and get insight. They also give you an opportunity to interview the attorney and get a feel for their experience. During a consultation, don’t be shy to ask about their past cases and their outcomes. How an attorney replies can give you a good idea of their success rate.

Consultation appointments can determine how comfortable you feel with a particular lawyer. Trust between a client and their attorney is paramount. If any of the answers to your questions make you feel uncomfortable or if you don’t trust their opinion, look elsewhere for representation. Only when you feel comfortable with a lawyer should you make the choice to hire them.

Consider the Merits of Your Case

Once you’ve found an attorney you like, ask about how they plan to handle your case. Is the person likely to settle the car accident claim out of court, or do they feel comfortable pursuing a trial in front of a judge and jury? Consider their communication style. Some attorneys handle everything on your behalf and notify you of important updates. But you may prefer regular updates of the progress of your case. Discuss these things with your potential attorney before you decide to hire them.

It’s also important to ask about the anticipated outcome of your case. Lawyers who promise large sums of money for a car crash, for example, could be cause for concern. Because every case is different, it’s difficult to anticipate the exact outcome of a specific situation. Attorneys should give ballpark figures instead of precise settlement amounts. When someone assures you a specific dollar amount, consider it a red flag.

Discuss Payment Options

Most injury attorneys work on contingency. This means that no money is due until the auto accident settlement gets paid. At this point the attorney gets paid a percentage (typically 33%) of the final payout. This kind of fee structure is helpful for those short on cash. Still, it’s important to ask about the percentage of payment they expect for their services. Failure to do so could result in unfortunate and costly mistakes.

Some lawyers charge more than others. Lawyers base their fees on their experience, education and success rate. A high fee doesn’t necessarily indicate a better chance of success. It’s important to weigh your options before opting for one attorney over another.

What Kind of Payout Should I Expect From a Car Accident Settlement?

A variety of factors go into deciding the average payout for a car accident. A judge or jury who hears your case will take into account:

- The types of injuries

- Treatment plan

- Length of therapy

- Loss of income

- Severity of the wreck

- Other factors

In most cases, a payout is only offered when the medical treatment is complete. Permanent injuries will influence the amount of compensation that you receive. If you’re working with an insurance company after a car wreck, let them know if you’re still going through medical treatment.

How Are Car Accident Settlements Calculated?

Calculating a car accident settlement is not an exact science. There are many factors that make your case different from others, even if they seem similar at first glance. A lawyer, the insurance company, and possibly the courts will need to look over the facts of your accident to make a fair determination of what your car accident settlement will look like.

If your accident only resulted in damage to your vehicle, the policy limits of the at-fault driver (or your insurance) limits your reimbursement.

Damages for pain and suffering are only awarded if you have sustained physical injuries. You will need to be examined by a medical professional after your accident to document your injuries. You should seek medical attention even if the accident isn’t severe. In many cases, injuries are not obvious right away and can develop days later. Get a medical assessment to check for internal or developing injuries.

One example of trauma that may not be immediately obvious is whiplash. You may be a little sore right after the car crash, but there are more serious problems that may not be obvious until a couple of days later. If you skip medical care or wait too long, it could have a negative impact on your settlement. You may not receive compensation to cover your medical expenses or your pain and suffering.

Get a Rough Estimate

If you are wanting a rough estimate of how much your car accident settlement may be,

- Add up your expenses for medical bills and lost wages.

- Multiply that total by three for an average.

Let’s say that you have injuries after a car crash and ended up with a total of $5,000 in hospital bills. Your accident made you miss one week of work, which lost you $1,000 in wages. That is $6,000 in expenses. Multipliers for a personal injury settlement vary from 1.5 to 5. What that multiplier actually is depends on the severity of your case. A high multiplier is not common. But you can get a range of what your settlement may be. Using these numbers, your payout will likely be between $9,000 and $30,000.

Obviously, that is a big range. Talking to a car accident lawyer will help you narrow that range and get a more exact idea of what you should expect. If you suffered more serious injuries, permanent disabilities, or the at-fault driver acted grossly negligent, you will get a higher payout.

If you are pursuing a claim through the at-fault driver’s insurance company, your payout will be limited by their policy limits. For instance, let’s say you have $20,000 in property damage due to the accident. But the other driver’s policy has a limit of $10,000. In order to get that other $10,000, you would have to file a lawsuit against them. Another option is to turn to your own insurance company and file a claim for underinsured coverage – if your own policy includes this.

Who Pays My Auto Accident Settlement?

If you have collision coverage and the crash was your fault, your insurance company will pay a certain amount to fix your car. If the cost to repair the damages is more than the value of your vehicle, the insurance company may consider your car totaled and give you a lump sum based on how much it’s worth.

Moreover, if another driver’s negligence caused the wreck, his or her insurance company should compensate you. The sum that the company offers may be much lower than you expect. It’s easy to get reimbursed for funds that you’ve paid out. It’s challenging to put a fair price on pain and suffering.

What Is Pain and Suffering?

In a car accident lawsuit, pain and suffering is the emotional distress and mental anguish that you have after the accident. Pain and suffering may result from:

- Physical pain and discomfort, whether it is permanent or temporary.

- Anxiety, memory loss, depression, insomnia, or other mental health issues

- Physical limitations, such as inability to hug your children or play with them.

- Loss of consortium with your loved ones

How Pain and Suffering Is Calculated in a Car Accident Settlement

There are two ways that pain and suffering compensation can be determined..

The first is the per diem method. This method assigns a dollar value for a single day (based on your daily wages), then multiplies it by the days affected by the injury. This method is rarely used by insurance companies to calculate pain and suffering..

The other way to determine pain and suffering is the multiplier method. This is most often used by insurance companies to calculate pain and suffering. This calculation adds up your economic damages and then multiplies them by a number from 1 to 5.

The tricky part with the multiplier method is figuring out whether your pain and suffering is worth a 1 or 5. You cannot tell the insurance adjuster that your pain and suffering is worth a 5. You have to provide documentation that justifies the multiplier you are claiming.

The only time you can claim a 4 or 5 for your pain and suffering is if the injury leaves you critically or permanently injured. For example, if the accident caused spinal fractures that caused you permanent pain, you may be entitled to the maximum amount of pain and suffering compensation (5). But, if your injury involves only a temporary sprain, you can only use a 1 or 2 as the multiplier.

When negotiating a settlement, most insurance adjusters will add a small amount on top of your economic damages to cover your pain and suffering. You should talk to your personal injury attorney to determine if the settlement is fair.

You can expect more compensation for pain and suffering if you experience permanent disability and/or inability to work.

What is the Average Settlement Amount for Pain and Suffering?

This is a difficult question, and one that doesn’t have a universal answer. While you can attempt to use a settlement calculator, they are often not comprehensive enough to provide an accurate answer. As always, it’s best to talk to a professional.

Yet, we can talk a little about how to calculate the value of pain and suffering. The answers to the following questions may help you determine an amount.

What kind of injury did you sustain? A good lawyer will use the average number from the type of injury to help calculate pain and suffering.

What was your economic loss? How long were you out of work? Did you have to quit?

What are your noneconomic damages? Noneconomic damages include the following.

- Emotional distress (lost enjoyment of life, distress over a disability, humiliation, psychological trauma, PTSD)

- Loss of consortium (love and affection, care, companionship, spousal intimacy)

- Physical pain and suffering (slipped disk, necked pain, pulled muscles, to name a few).

How much of the fault was yours? Sometimes this number is 0%, and sometimes it is not. In a few states, being even partially at fault will entirely negate your claim, so it’s important to know.

The average amount from a pain and suffering case is between $15,000 – $35,000 when settled out of court. Generally, pain and suffering claims involve minor injuries so the settlement amounts are not as high when involving serious injuries.

If serious injuries accompany a pain and suffering case, payouts can be much higher.. The severity of an injury will almost always be the largest factor in determining a settlement’s value.

Talking to someone experienced will give you the best range you can expect in a pain and suffering claim.

Do I Need a Lawyer for My Pain and Suffering Case?

It is not necessary for you to have a lawyer to go to court or send a demand letter for a settlement. However, there are cases in which pain and suffering would not pay out without proper legal representation.

A woman’s daughter had an accident in a rental car that resulted in pain and suffering as well as broken bones. Her daughter needed to have surgery to repair her arm. While the insurance company did cover the economic losses, they did not pay for pain and suffering.

Try as she might, the woman was unable to get help from the rental car’s claim company. They refused to answer her inquiries until she involved a professional lawyer. This was not because her daughter did not deserve a pain and suffering settlement. Rather, sometimes an insurance company can get away with inaction without proper legal pressure.

In the end, a very seasoned adjuster had taken on this case and the claim settled for over $150,000. This would not have happened without legal representation.

Nearly 100% of the $150,000 was for pain and suffering; less than $100 was for out of pocket medical bills. Without legal representation, the total payout for this claim would have been $43.

Negotiating a Car Accident Settlement

Car crashes are scary. Even if you end up with few to no injuries, the loss of control over your personal safety can be rattling. This is especially true when you’ve suffered serious damage to your vehicle, your health, or your personal property. After you’ve been in a wreck caused by a negligent driver, it can feel like your fate is out of your hands.

That sense of frustration continues as you navigate the requests of the insurance company. While we like to think of insurers as working for us, the truth is far less affirming. Insurance companies are out to make money for their shareholders. They’re looking to deny claims whenever they can. When they can’t, they offer the smallest settlements possible. For many accident victims their experience with the insurance company can be maddening. It leads many people to wonder: can I negotiate my car accident settlement?

Accident victims can negotiate the terms of their case and payout. Though easier with an attorney representing you, the process is possible independently. Keep reading to learn more about the best strategy to use to get the compensation you deserve.

How the Car Accident Settlement Negotiation Process Works

When you inform the insurance company of your accident, the adjuster may make arguments against your claim. They may point out reasons why the incident wasn’t as devastating as you claim. In some cases, they’ll look for any reason possible to deny coverage. Often, they’ll offer an initial settlement amount that feels too low for your needs. You can counter or take time to think about the offer. Accident victims frequently turn to an experienced car crash lawyer for guidance.

An attorney can help you create a demand letter outlining your needs. In such a letter, you can list out your expenses associated with the wreck and how best to make you whole again. Medical costs, car repairs, lost wages, and even the pain and suffering you endured can be assigned a dollar amount. Demand letters provide a helpful starting point for negotiations.

Writing a Demand Letter

When creating your demand letter, have a lump sum in mind for understanding what your claim is worth. From there, consider how low you are willing to go in negotiations. Having a floor and a ceiling for negotiations is important – a good car accident lawyer can help you understand this strategy. This range is for you to keep in mind when negotiations begin in earnest. Keep your bottom line in mind when the insurance company pressures you to settle. You are under no obligation to share this information with the claims adjuster.

Instead, make sure your demand letter reflects the truth about your incident. Be clear in your demands and present evidence to back up your claims. Medical bills, reports from the doctor, pay stubs reflecting the work you missed and other documents can help bolster your claim. The more support you have in your demand letter, the better your odds of getting the settlement you deserve.

Resisting Low Settlement Offers

After the insurance company receives your demand letter, they’ll likely offer you a small auto accident settlement. While it’s tempting to put the whole thing behind you, taking the first offer is typically a bad idea. The initial offer should be the base from which you negotiate upwards. If they offer you a reasonable amount, make a counteroffer that is a little lower than the figure you requested in your demand letter. This signifies to the claims adjuster that you’re willing to compromise. A little more effort when bargaining should get you to a number you feel good about.

Another strategy to consider when low offers are in play? Ask the claims adjuster to justify their low-ball offer. Ask for specific reasons why the number is so low when compared to the costs you’ve incurred. Make note of their explanation and write a short letter responding to their argument. Depending on the strength of their logic, you may want to lower your demand amount. Wait until after the claims adjuster has received your letter to lower that amount. Ask for a response to your letter and see if anything has changed in their mind.

Get The Settlement Offer In Writing

As negotiations continue, emphasize the emotional weight of your argument.. No dollar amount can be assigned to the emotional impact the crash has had on you . The weight of sharing an upsetting accident scene photo or a story of the impact the accident had on your child can sway even the most experienced of claims adjuster. Don’t stray from the facts, but don’t be afraid to appeal to the human nature of the person on the end of the line, either.

Once you get to a number you feel good about, be sure to get the agreement in writing. Outline the settlement you’ve agreed upon in a short letter to the adjuster. Include details about how much you’ve settled on, what the money covers, and the date you expect to receive compensation.

How are Car Accident Settlements Paid?

Once you have settled the claim, it may take some time to actually get paid. For large car accident settlements, you may see the lump sum broken up into several payments paid out over a few years. If you need the entire settlement upfront, be sure your lawyer negotiates this arrangement ahead of time.

Upon receipt of your settlement, your lawyer will deposit the money into an escrow account or trust. This is mandatory in most states. Once the check clears, your attorney will distribute the cash. You may want to have them send portions of your settlement to pay off any accident related debts. Failure to resolve these liens may result in expensive penalties.

Before you spend any of your settlement money, create a list of outstanding debts. From your settlement, you’ll need to pay off any medical debt you owe because of the accident. Make out payments to any mechanics or body shops. Your attorney will also require payment. In many cases, their payment structure demands a certain percentage of your settlement. If you have questions or concerns about your legal fees, ask your attorney for clarification.

When creating this list of liens, it also helps to plan for tax season. It is a requirement that you pay taxes on the money you received for lost wages and emotional distress. On the other hand, you won’t owe taxes on medical expenses or for crash related pain and suffering. Work with an accountant to better understand your tax situation.

The settlement process isn’t as straightforward as the insurer simply dropping a check in the mail, though. Typically, insurance companies will pay out car accident settlements in about six weeks. Understanding what to expect helps you’ll be better prepared to handle the claims process and get the settlement you deserve.

How are Auto Accident Settlement Amounts Determined?

If you find yourself injured after an accident, it is natural to ask what the value of your car accident settlement might be. Many assume that the auto insurance industry has devised a standard formula to determine the value of a personal injury claim. This is not so.

There are statistics compiled by auto insurance companies that suggest an average value for certain types of car accident claims. But it is rare for a particular claim to fit the exact profile of an average claim. The value of your claim depends upon many factors. Below is more information about some of the larger variables and how they can affect your auto accident claim.

Special Damages

A common way that auto insurance adjusters determine the value of an injury claim is to multiply your special damages by a certain number. Special damages are your financial losses from the accident. They include medical bills, lost earnings, out of pocket expenses, etc.

Using a Multiplier

A multiplier gets a rough estimate of what your total claim could be worth, including your pain and suffering.

In many auto accident claims, the adjuster may use a multiplier of 2 or 3 to come up with an estimated value. For example, let’s say that the total of your medical bills and lost earnings from your car accident is $5,000. If the auto insurance adjuster multiplied the sum by 2, then the claim would be worth $10,000. But if your pain and suffering is worse, they might multiply the $5,000 by 3, so you would get $15,000.

You may wonder why the auto insurance company is multiplying your special damages by 2 or 3. They are trying to guess what the jury might award you if the auto accident case goes to trial.

A multiplier of 2 or 3 is often used for a moderate or average amount of pain and suffering in a car accident case. If you suffered minor injuries, the multiplier might only be 1 or 1.5. Only people who have suffered long term or even permanent injuries would induce a multiplier of 4 or 5. You also would see the higher multiplier if you have much more in medical bills, such as $50,000 or more. This would indicate a serious level of personal injury that could take years to recover from and might result in a disability.

Keep in mind that once the auto insurance company arbitration process comes up with a value for your claim, that does not mean you must accept it. You can continue to negotiate with the insurance company. You may decide to file a personal injury lawsuit against the person who injured you.

Does Totaling my Car Mean Insurers Will Pay More for My Settlement?

It is likely that your settlement will be higher if your car accident resulted in a totaled car. Since totaled cars and soft tissue injuries or whiplash often go hand in hand, a higher settlement amount is common.

Sometimes, a totaled car can be strong evidence of economic injury. This is especially true if the car was used for commuting or for work. Damage to a car can increase the amount of a settlement all on its own with the right lawyer.

How Are Damages Paid After a Car Accident?

When someone hits your car, your first thought likely is “What just happened?” Your second thought then becomes “Am I okay?” Regardless, your third thought might be “Who’s going to pay for this?”

Unfortunately, you can expect to sustain some sort of damages in any car accident. At the very least, your car is likely damaged. At worst, you may have received injuries that could result in any or all of the following:

- Ambulance bills

- Hospital bills

- Prescription drug bills

- Physical therapy bills

- Rehabilitation bills

- Nursing home or assisted living bills

- In-home care bills

All these and more represent your damages arising out of your car crash. If you’ve ever wondered how car accident settlements pay out, the surprising answer is: It depends. While you may assume that the person who caused the accident pays, his or her insurance company will likely be the one signing the check.

Insurance Company Tactics

Insurance companies like to collect premiums and don’t like to pay claims. Consequently, a representative from the other driver’s insurance company will offer you a “quick and easy” settlement for your car accident. Your best interests dictate that you decline this settlement offer. This represents the least amount of money the insurance company thinks it can pay you. When you accept a settlement, you sign a release absolving the insurance company from further liability. It also eliminates the possibility of you bringing a lawsuit against its policyholder.

Your better course of action is to contact an experienced personal injury attorney. You always have the legal right to sue the driver whose negligence caused the accident. You never have any obligation to accept an insurance company’s settlement offer. Your attorney will have experience in negotiating with insurance companies. In most cases the attorney can get you a better car accident settlement than you could get for yourself. Also, the attorney can file a lawsuit on your behalf against the other driver and pursue your damage claims in court if it does come to that.

Policy Limits and Personal Liability

Keep in mind that no insurance company will pay any amount above the limits of the policyholder’s policy. Should you win a court judgment more than this amount, the policyholder becomes liable for the balance. Collecting that judgment may well be easier said than done.

Judgment Collection

Few people have the assets available to pay a large money judgment, especially all at once. Some people may think that if they ignore you long enough, you’ll go away. Depending on which state you live in, you may be able to incentivize the person to pay your judgment by notifying the Department of Motor Vehicles. This causes the person’s driver’s license to become suspended until he or she pays you in full.

The Types of Damages in a Car Accident Settlement

No one plans for a car crash, but that doesn’t mean it won’t happen. The severity of the accident may range from no damage to a serious wreck. It is the latter that usually leads to a mountain of bills, pain and long-term recovery. A car accident claim falls under personal injury tort. Compensation under this type of legal matter is a financial award called damages. These are compensatory in nature because they make up for what a plaintiff lost because of the crash.

Take a closer look at some of the most common types of compensation in a car accident case.

Medical Care

Getting injured as a result of someone else’s carelessness can spell financial disaster. Depending on the extent of the injuries, medical bills may pile up. If long-term medical care and treatment are necessary, who pays? In the case of a lawsuit, there is a fair chance that the court will award damages for medical bills. Ongoing medical care may also be part of a compensatory damages award.

Lost Wages

Being out of work for any length of time can send even diligent households into a tailspin. Savings may run out after a prolonged work absence and bills resulting from the incident. Getting reimbursed for missed income is common in car accident claims. Physical limitations caused by the injury may also force a change of jobs or a premature exit of the workforce . Consequently, a court may consider awarding damages for the loss of future earnings.

Pain and Suffering

The plaintiff, or victim in the accident, most likely experienced a significant level of pain due to the injuries. Pain and suffering are subjective and not easily proven. Some injuries are serious enough that it is a reasonable assumption that there was a significant amount of mental anguish and physical pain. Doctors can testify on the level of pain and suffering associated with similar injuries to help make the case.

Loss of Consortium

One unique type of compensation in a car crash case is the loss of consortium claim. This claim requests compensation for the losses associated with a personal relationship such as:

- Affection

- Intimacy

- Companionship

- Future endeavors

For example, if a spinal cord injury rendered the plaintiff paralyzed, this will have significant effects on a relationship. The spouse or partner may file a loss of consortium for the impact this medical issue has on them. This type of compensation request can only be in addition to other damages.

An attorney can best supply further guidance on the types of compensation in a car accident case. There are services that provide attorneys with leads to help them reach out to victims.

Can I Get Compensation for My Child Being Injured in a Car Accident?

Most parents dread the thought of their children injured in a car crash. You can get car accident claim compensation for your child’s injuries after a crash, as with any other passenger.

The first thing to understand in such accidents is that a person under 18 cannot legally file a claim. A person known legally as a “next friend” can file a claim on the child’s behalf. The parent is usually the “next friend” who files the legal claim. There are no requirements for a legal proceeding to occur to state the person named a next friend.

When it comes to filing a personal injury lawsuit, most states have a statute of limitations of two or three years from the date of injury. But many states’ statute of limitations does not begin until the child turns 18. Thus, a person injured in a car accident as a minor generally has until age 20 or 21 to file a lawsuit.

When a child is injured in a wreck, they can be entitled to the following damages:

- Medical bills

- Ongoing medical care

- Therapy and rehabilitation services

- Loss of ability to earn a living in the future

- Pain and suffering

- Loss of enjoyment of life

The parents may get compensation for the financial losses they incurred, such as the child’s ongoing medical costs. Depending on the case, auto accident victims and their family may get punitive damages. These damages are only for very serious accidents. Punitive damages aim to punish defendants.

A car accident claim involving an injured child usually needs approval by the court. In Virginia, for example, a circuit court judge typically will approve the child injury settlement.

During a hearing, the judge will determine if the car accident settlement for the child is fair. To decide this matter, the court could appoint a guardian ad litem to aid in the process. To help make the decision, the judge may ask questions to stakeholders in the case, such as the parents of the child:

- Extent of injuries to the child

- Current health status

- Education status

- Disabilities that were caused by the accident

- Medical needs and rehabilitation needed in the future

Once the court approves the settlement, the next friend will sign off on it. The child is bound by the settlement decision.

After approval of the auto accident settlement, the court has latitude on disbursement of the funds. Depending on the case, minors may receive all the settlement funds when they turn 18. In other cases, settlements are set up to pay a certain amount of damages per year for a certain period. After approval of this sort of payout, the court places the funds in a trust. Funds distribute per the settlement structure, beginning after the child turns 18.

What Are Compensatory Damages From a Car Accident?

If you become involved in a car wreck, you may well suffer injuries, some of which could be catastrophic. When you file a personal injury lawsuit, you are seeking compensatory damages. If successful in your suit, the judge or jury will award you these damages. This is an attempt to reimburse you for your expenses and make you as whole as possible. Keep in mind that compensatory damages from a car accident come in two types, general and special.

General Compensatory Damages

General compensatory damages are non-economic in nature and can cover such things as the following:

- The pain and suffering you experienced or will experience in the future as a result of the accident

- The mental and emotional anguish and distress you suffered or will suffer

- Any disfigurement you suffered

- Your loss of consortium with your spouse, children, parents, and/or other family members

- The loss of your enjoyment of life

- The loss of any opportunities you had to forego

Special Compensatory Damages

Conversely, special compensatory damages represent economic damages that you have already sustained or will sustain in the future:

- Your ambulance and medical bills related to the car crash, both now and in the future

- Any hospital, nursing home, or rehabilitation facility expenses you have already incurred or will incur in the future

- Physical or occupational therapy expenses you have already incurred or will incur in the future

- Household expenses you have incurred as a result of your injuries or will incur in the future for such things as medical equipment, in-home care, etc.

- Earnings you have already lost and will lose in the future from being injured and unable to work

- Any costs associated with plans you had to alter or trips you had to cancel as a result of your car crash injuries

- Your property damage, such as the damage to your vehicle

- Your legal fees associated with bringing and pursuing your personal injury lawsuit, including attorneys’ fees, court costs, transportation costs, etc.

Actual Car Accident Settlement Example:

On June 11, 2020 I was driving my Honda Civic to go pick up my girlfriend from her house. It was 5:15 p.m. and the sun was just starting to go down. I came to the intersection at Broadway & 49th Street with four stop signs, known as an “all-way stop” intersection. I made a complete stop and looked from left to right to make sure that it was clear to proceed, when suddenly and without notice I was broadsided (T-boned) by another vehicle that ran the stop sign, causing my injuries and damages. The intensity of the impact caused full airbag deployment throughout my vehicle. Immediately after the hit, I was shocked and felt immediate pain to my neck, back, shoulders, head, and forearm. The airbags were in my face, and when I tried to open my drivers side door it was jammed shut. I climbed over the seat and exited my vehicle from the front passenger side. When I finally got out of my vehicle I called 911.

Lateral collisions are uniquely dangerous. This is so because when a vehicle hits the front or back of a vehicle, there are several feet of steel, bumper, engine, trunk, and seats protecting the occupants. However, when a vehicle is T-boned, there is only a door and a window between the occupant and other vehicle.

The police and paramedics arrived on scene. I had cuts, bruises, and abrasions to my face, neck, and scalp. I also had a burn on my upper forearm from the airbag. I am unsure whether I lost consciousness, and felt completely dazed when I was talking to the paramedics. I made a statement to the police while EMS was examining me. The police informed me that the other driver admitted that he was using his cell phone and did not see the stop sign. This was a major relief because the police told me that I was not at fault for the crash. At this point, I knew that his insurance company would pay for my damages. The paramedics advised that I should be transported to the hospital to be checked out. I was reluctant, but eventually agreed. At this time, they put me in the ambulance and transferred me to UCLA Medical Center for treatment of my injuries.

Injuries

Upon arrival to UCLA Hospital I was shaky and nervous. I had never been involved in an auto accident before. I had excruciating low back, neck, shoulder, head, and forearm pain. My low back pain was radiating down to my legs and causing numbness and tingling. I let my doctor know my symptoms and they took X-rays of my neck and low back. My X-rays came back negative for any fractures or dislocation. They took a CT of my head to make sure there was no brain bleed after the car accident. My CT came back clear which was great news. My pain levels were 8-9/10 and they administered a shot of Toradol which is a non steroidal anti-inflammatory medication. I was discharged home later that evening with instructions to seek further care and treatment for my injuries.

I went home and tried to rest for the evening, but my pain and symptoms continued to worsen. I was finally able to sleep and woke up the next morning in significant pain. The doctors at the emergency room told me that my pain may gradually worsen, and when I woke up that morning, I knew that they were right. I called off work the next day due to my pain and discomfort. At this point, I knew that I needed to seek professional medical attention for my injuries. I was worried about missing time from work, but knew that I needed to get better and would not be able to perform well at my job.

Later that day, I called a chiropractor near home and they were able to see me right away. The chiropractor asked me for a full history of the accident and what my symptoms were. At this time, I had severe neck, low back, shoulder, head and forearm pain. The chiropractor adjusted me and hooked me up to a TENS unit which provided some temporary pain relief. He recommended that I come in 2-3 times a week for treatment which I did for over two months. Unfortunately, my pain and symptoms failed to subside so my chiropractor prescribed an MRI of my right shoulder, and cervical spine (neck).

On August 14, 2020 I presented to Get Well MRI for the recommended right shoulder and neck (cervical) MRI. The MRI facility sent the results to my chiropractor and the impressions revealed the following:

Right Shoulder MRI:

- Supraspinatus tendinosis with partial tear of supraspinatus tendon.

- No fracture or dislocation.

- Intact rotator cuff. At increased risk for impingement syndrome

Cervical MRI:

C2-3: 3 mm protrusion with mild-to-moderate stenosis.

C3-4: 4 mm protrusion. Disc material indenting thecal sac.

C4-5: 2-3 mm protrusion with abutment on bilateral exiting nerve roots and mild to moderate bilateral neural foraminal stenosis

C6-7: 6 mm disc protrusion indenting the thecal sac. Annular tear seen at this level with bilateral neural foramina nerve root impingement.

C7-T1: 2 mm protrusion abutting the bilateral exiting nerve root with moderate to severe stenosis. Annular fissure (tear) seen at this level.

Since my MRI’s showed positive findings, my chiropractor referred me to an orthopedic physician and pain management specialist.

On August 17, 2020 I presented to Dr. Faar, M.D., an orthopedic physician in Los Angeles California for treatment of my injuries. Dr. Faar reviewed the results of my MRI with me and advised that I sustained a partial tear of the supraspinatus tendon of my right shoulder as a direct result of the crash. My cervical MRI showed multiple disc herniations with nerve root impingement which is the cause of my radiating pain. At this time, my shoulder and neck pain was waking me up at night and I was unable to lift heavy objects.

In fact, the pain was so severe that I could barely lift my arm over my shoulder. I could not effectively turn my head from left to right without feeling stiffness and soreness. I was unable to perform my activities of daily living such as cooking and cleaning the house. Even the simplest of tasks such as bending down to tie my shoes and holding my dogs leash caused significant pain and discomfort. I never had an injury to my shoulder, neck or back before, and felt significantly impaired. I was prescribed Tylenol and Norco for pain, and instructed to continue with chiropractic therapy and come back for a follow up in two weeks.

Two weeks later, I returned to Dr. Faar, M.D. for a follow up. The pain in my right shoulder and neck was constant throughout the day. My pain levels were 7-8/10. The pain was burning, sharp, and stiff. At this point, I was fearful that I would never return to my pre-accident state of health. Dr. Faar recommended that I undergo a right shoulder steroid injection for treatment. I returned home later that evening and made the decision to move forward with the injection.

One week later I returned to Dr. Faar, MD for the recommended right shoulder steroid injection. The procedure went well and provided me with substantial pain relief. I continued treatment with the chiropractor and my low back and shoulder pain from the car accident finally began to subside.

Unfortunately, my neck pain was still sharp and constant throughout the day. At this time, Dr. Faar recommended that I undergo a bilateral cervical epidural injection at the C6-7 level. He advised that the cost of the procedure would be approximately $15,000. Since the other drivers insurance company had accepted liability, I decided to move forward with the cervical epidural injection two weeks later. The injection provided me with with much needed relief from my neck pain, and I was finally able to rotate my head from left to right without pain. In short, the cervical epidural provided me with the most pain relief I had felt since the initial injury.

I returned for a follow up visit with Dr. Faar, M.D. one week after the injection. At this time, my pain levels had decreased to 6-7/10. Dr. Faar recommended that I begin physical therapy 2-3 times a week for 3 months. He provided me with a prescription & referral for physical therapy that was close to home, which made it convenient to come in for my much-needed treatment.

On October 15, 2020 I presented to Happy Health Physical Therapy & Sports Medicine in Los Angeles California for treatment of my injuries. The goal of physical therapy was to decrease pain and improve my active range of motion in my neck and right shoulder. I continued treatment here 2-3 times a week for approximately 3 months prior to being discharged with symptoms.

Negotiation & Car Accident Settlement

Although I continued to experience pain and symptoms, I knew that it was time to collect my medical records and bills from all treating doctors and send a settlement demand to the at-fault drivers insurance company. The other driver was insured with AAA and the insurance adjuster had previously disclosed that the driver that struck me carried a 50/100 policy. This means there is $50,000 of bodily injury coverage per-person with $100,000 available per accident.

At this time, my medical bills were $28,500, so I sent a Policy Limit Settlement Demand to the bodily injury adjuster with AAA. I gave the insurance company 14 days to respond with an offer. After 14 days, the adjuster called me and made an initial settlement offer of $40,000. I had suffered from significant injuries and damages and also missed time from work. After everything that I had been through, I felt that my case was worth the full $50,000 policy limits. I decided to send a counter-offer to the adjuster, and submitted a letter from my job showing lost wages. Four days later, the adjuster called me and tendered the other drivers full policy limits of $50,000 to settle my auto accident case.

More Actual Car Accident Settlement Examples:

Since it’s helpful to understand average car accident settlement amounts that include a wide variety of car accident injuries, different insurance companies and accident circumstances, and in a range of different states. Here are a number of additional examples:

$100,000 Car Accident Settlement

A woman was hit by a car crossing the street while walking from a dinner with friends near Miami Beach. The force of the car hitting her sent her airborne and she hit the ground so hard she hit her head and had trouble getting up.

In addition to a herniated disc suffered in the crash, the accident also aggravated her pre-existing bulging discs at C3-4 and C5-6. The woman also suffered a back injury and a broken nose, leaving her unable to work or exercise for over a month.

The driver was at fault, and the woman received a $100,000 pedestrian injury settlement from GEICO, the at fault driver’s insurance company. .

$27,000 Car Accident Settlement with Multiple Injuries

A driver ran a stop sign. He hit another driver in a truck from behind. The injured driver’s vehicle flipped over several times. Liability was clear, and there was no comparative negligence on the injured driver.

The injured man suffered a head injury in the car accident. He also suffered neck injuries and injuries to his left shoulder and leg.

He went to a spine and rehab center in South Florida for evaluation a few days after the accident. He suffered from radiating pain in his mid-back and neck. His pain level was 9 out of 10. Bending and twisting his body and turning the head made his pain worse.

The exam showed he had less range of motion in the spine and muscle spasms in the spine. He also had a cervical neck strain and sprain, a thoracic strain and injury, and neck contracture.

There was only $10,000 of coverage for bodily injury on the careless driver’s insurance and $10,000 on the injured driver’s uninsured driver coverage. The case settled for $27,000.

$10,000 Back Pain Car Accident Settlement

A driver stopped in the emergency lane on I-95 in North Carolina. A driver slammed into the back of his car. State Farm insured the at-fault driver.

The man’s injuries included back pain and a large cut on his left eyelid. He received treatment at an eye center and two hospitals.

State Farm paid the bodily injury limits of $10,000. But the driver of the car that hit him had no insurance. Unfortunately, the injured driver did not carry underinsured coverage, which limited his settlement to $10,000.

Underinsured and uninsured coverage costs only an extra $10 or so per month. It can be critical in many car accidents. In this car accident settlement example, it probably cost the victim tens of thousands of dollars in compensation for the car accident.

$33,000 Car Accident Settlement

A car hit a 48 year old man’s bike in Brooklyn, NY. He broke his lower leg – specifically a tibial plateau fracture. His physician said the fracture healed perfectly, and no more treatment was needed.

State Farm insured the vehicle that hit the biker. Personal Injury Protection (PIP) paid $10,000 to the man’s doctors for his medical costs. The other driver’s State Farm coverage paid the rest of the leg injury car accident settlement.

$125,000 Car Accident Settlement

A car hit another car from the side, also known as a sideswipe collision. The passenger in the second car suffered an open distal radius and distal ulnar fracture. This is an open fracture of the wrist. She also had lacerations to tendons in her fingers. A doctor performed surgery on the woman’s hand.

Police ticketed the other driver for failure to yield. The liable driver had minimal bodily injury protection. State Farm insured the at-fault driver, and also the injured passenger, who had uninsured driver coverage.

State Farm offered $80,000 on the injured party’s coverage. But the attorney refused to settle for anything less than the policy limits – $135,000. Why? The woman needed surgery, which always increases the value of a case.

$200,000 T-Bone Car Accident Settlement

A driver t-boned another driver at a busy Miami intersection. The ambulance took her to a local hospital. The X-ray showed she suffered a broken risk. The doctor did surgery in the fractured risk, including inserting a plate and screws.

USAA had a $100,000 bodily injury policy with the at-fault driver. But the attorney pressed the case and found out that the driver was on the job at the time of the accident. Another insurance company insured the at-fault driver, and the result was a $200,000 T-Bone Accident settlement for a broken wrist.

$100,000 Car Accident Settlement Involving Cyclist

A pickup truck hit a biker in Texas. A helicopter airlifted her to the hospital. The police officer stated that the biker had on dark clothes and the accident occurred at night. The at-fault driver could argue that he could not see the biker.

However, the police saw the woman’s flashlight near the crash scene. The flashlight worked when the crash happened, so the victim argued that the driver should have seen her.

The woman suffered scarring and disfigurement to her face and abdomen. She suffered several facial fractures. Doctors inserted five screws into her facial bones. The victim also needed surgery to fix two collapsed lungs.

The pickup truck driver had a $100,000 bodily injury policy with USAA. The victim did not have any uninsured driver protection, so the maximum settlement was $100,000. Her medical bills and pain and suffering exceeded $100,000, but the attorney persuaded the hospital to take $33,000 for her hospital bill.

$70,000 Car Accident Settlement Involving Pedestrian

A driver saw a hose in the middle of the street while driving in Southern California. It was day time. She wanted to get the hose, so she made a U-turn. The driver exited the car to retrieve the hose. Another driver hit her when she was walking back to her car.

Additionally, her attorney claimed the pedestrian accident caused a broken leg, sacrum fracture, shoulder impingement, herniated discs, and four bulging discs.