It can be hard to deal with the aftermath of a car accident, and sometimes dealing with the insurance adjusters can seem like a friend who’s there to help guide you through a tough time. However, it’s important to remember that insurance companies are for profit businesses, and their ultimate loyalty lies with their bottom line and their shareholders. As a result, insurance companies frequently make low car accident insurance settlement offers to people who’ve been injured in car accidents, often leaving the injured person to pay out of pocket for a good portion of the medical bills, lost income, and property damage they suffered as a result of the crash.

Find out the maximum compensation you could receive.

If you find yourself in a position where you’re negotiating a car accident insurance settlement without the help of an experienced attorney (or with, for that matter), it’s important to understand the business model of an auto insurance company, and the incentives they have to make you a low settlement offer. It’s also important to understand how accepting these offers without digging deeper or pushing back can hurt your case.

Most of us have accepted that paying for car insurance is a part of life, much like a monthly utility bill. After all, nearly every state requires liability insurance and property damage insurance. But many of us also assume that if we are involved in a car accident, our insurance company or the at fault driver’s insurer will compensate us for the damages that we incur. Unfortunately, it is not that simple.

The auto insurance industry is massive and highly profitable. And it did not get this way by insurance companies shelling out big bucks to anyone that files a claim. Rather, insurance companies have every reason to pay claimants as little as possible. Let’s take a closer look at why that is and what you can do to ensure that you receive adequate compensation for your car accident losses.

What is considered a “Low” Car Accident Insurance Settlement?

A low settlement offer could be defined as an amount of money offered by an insurance company after a car crash that fails to cover all costs related to a car accident. These offers are supposed to cover the full cost of medical bills, lost wages, and property damage associated with an auto accident, but often fail to do so. In addition, they may not take into account any non-economic damages, such as pain and suffering related to the crash.

These low settlement offers are made in hopes that you will accept them without challenging them. Auto insurance companies know that if they can convince you to accept a lower settlement, it will save them money. The problem is that when you accept this type of offer from an insurance company, you’ll often end up paying out of pocket for additional expenses related to the accident that were not covered by their lowball offer.

In this article we’ll examine the business reasons behind why insurance companies often try to short change their payouts on car accidents, the damage this can cause to an injured victim, and ways you can protect yourself should you ever find yourself in a contentious car accident insurance settlement negotiation where you feel the offer isn’t adequate to cover your damages.

What Exactly Is a Car Accident Insurance Settlement?

A car accident Insurance settlement is a negotiated agreement between the car accident injury victim and the at-fault driver’s insurance company. In theory, the settlement amount should be enough to cover all of the damages suffered by the victim due to the accident, including medical bills, property damage, lost wages, and pain and suffering. Insurance companies often attempt to make low settlement offers in order to save money; however, claimants can protect themselves from unfair offers by finding an experienced attorney who can help negotiate higher settlements or file an auto accident lawsuit if necessary in order to ensure they receive fair compensation for their losses.

Why Auto Insurance Companies Make Low Car Accident Settlement Offers

The primary reason why auto insurance companies make low settlement offers is to save money. Insurance companies know that if a claimant accepts their offer, it will save them from paying out large sums of money in settlements and legal fees. They also hope that a claimant will accept their offer without questioning it or challenging it in court.

Auto insurers also frequently underestimate the cost of damages caused by an accident. When calculating how much money to pay a claimant, they often fail to include all of the costs associated with an accident such as medical bills, lost wages, pain and suffering, and property damage. By underestimating these costs when making settlement offers, they can once again save money while offering claimants a sum that is far lower than what they actually deserve.

Understanding How Auto Insurers Stay in Business

Auto insurance companies are in the business of making money, and their business model is built around saving as much as possible when settling car accident claims. There are 2 main parts to an auto insurance business – taking in money in the form of premiums, and paying out money in the form of claims. Just as in any business, success is defined by how much more money an insurance company takes in than they pay out in expenses. The biggest expense these companies incur is always claims, and their total income is usually pretty close to the difference between premiums collected and claim payouts. As a result, they often employ tactics such as making low settlement offers to car accident victims in the hopes of keeping more of the premium revenue they take in.

Insurance adjusters are well trained to use various tactics when dealing with claimants in order to keep the costs of settling car accident claims low. One of these tactics is making lowball offers that they know won’t cover all the costs and damages associated with the crash. But insurance adjusters will still make lower than average car accident settlement offers knowing that some claimants will accept them due to lack of knowledge, lack of time, or financial constraints.

Training for insurance adjusters includes understanding the tools used by insurers such as formulaic approaches, cost containment strategies, and negotiation and settlement techniques. They learn how to leverage data points such as medical records, property damage reports and other evidence in order to assess overall liability and valuation for a claim. They also understand common legal terms used in car accident insurance settlements so that they can present clear assessments about claims that favor the insurers’ interests rather than those of the claimant.

It’s important for car accident victims to understand the tactics employed by auto insurers when making settlement offers so that they don’t fall victim to an unfair offer from an insurer who is more interested in saving money than providing fair compensation for damages caused by an accident. The best way for a claimant to protect themselves from unfair settlements is by finding an experienced attorney who can help negotiate higher settlements with your insurer or file a lawsuit if necessary in order to ensure you receive fair compensation for your losses. Car accident lawyers often have similar training to car insurance claims adjusters, so they are much less likely to fall victim to these tactics than the average person.

Auto Insurers Reap Record Profits During the Pandemic of 2020

Auto insurers across the country have been reaping huge profits as a result of the pandemic, while consumers are left without proper protection from state insurance regulators. A recent report from the Consumer Federation of America revealed that auto insurers made an estimated $30 billion in “windfall profits” during 2020. As we have illustrated, there are only 2 ways an auto insurance company can make record profits:

- Take in record high amounts of money for insurance premiums.

- Pay out record low amounts of car accident claims.

While this jump in profit is great news for the auto insurance industry, it has had severe consequences for consumers across the country. Insurance companies have used the lack of regulation to increase premiums and reduce payouts on claims – leaving many people with little recourse when it comes to their coverage. Furthermore, these companies have also been able to get away with unfair practices such as denying legitimate claims or raising premiums without cause.

This lack of oversight from insurance regulators has left many consumers feeling powerless and frustrated that they are not being properly protected from these unfair business practices. Unfortunately, there does not seem to be any actionable steps being taken at this time to address these issues. As a result, auto insurers continue to make massive profits off of unsuspecting consumers who are forced to pay higher premiums and receive less in return when they do have to file a claim.

The fact that auto insurance providers have been able to take advantage of this situation with very little consequence is alarming. Consumers should make sure they understand their policy and regularly check policies for changes or discrepancies so they don’t fall victim to expensive rate hikes or denied claims due to loopholes or clauses written by insurance providers. As we see over and over again, clearly their priority is on profit, not the well being of the people filing car accident claims.

The Financial Impact of Accepting a Low Car Accident Settlement Offer

Accepting a low car accident insurance settlement offer can have significant long-term financial implications, as it often fails to cover your current and future medical costs, lost wages, property damage or other damages caused by the accident. In addition, once an agreement is reached with an insurance company it cannot be changed—so if you accept a low offer and end up needing more money down the line due to additional medical bills or lost wages, you will be unable to ask for more compensation from the insurer and as a result, will be forced to pay out of pocket (or file for bankruptcy if you can’t pay) for these expenses.

If you end up missing work, or losing clients because of the loss of work/ability to work, this could have long term implications on your financial future. This should be factored into any car accident insurance settlement negotiation.

Decreasing Trust in the Auto Insurance Industry

A recent survey indicates that customers’ satisfaction with auto insurance companies is continuing to decline. According to the study, which looks at customer service and overall customer experience, only 57% of users are satisfied with their auto insurance provider.

This could be attributed in large part to rising premiums, lowball settlement offers, and a general lack of transparency from most, if not all auto insurance companies. Other factors contributing to declining customer satisfaction include long wait times on the phone, slow claim processing times, and difficulty reaching an agent on the phone or online. In addition, poor communication between insurance companies and their customers can lead to confusion around billing issues and other policy related matters.

Given that customer satisfaction plays a key role in shaping public opinion and trust in an industry, auto insurers need to do more to improve the customer experience if they hope to win back consumer confidence.

How Do You Negotiate a Settlement With An Insurance Claims Adjuster?

Now that we understand the importance of not accepting a lowball auto accident settlement offer, let’s examine some ways you can secure a higher settlement for yourself and your family:

- Write a strong demand letter: Most car accident insurance settlement negotiations begin with the plaintiff (victim) writing a demand letter. The letter generally outlines the injuries sustained in the crash, circumstances that led to the accident, and the damages to person, property, and earning potential that occurred as a result. Here is a sample truck accident settlement demand letter for someone who was injured when a semi-truck hit them head on:

To whom it may concern,

I am writing to demand a settlement of $125,000 from the insurance company of the truck driver involved in the accident that resulted in my injuries and vehicle damage.

I was driving my Lexus IS 350 northbound on Pacific Highway in San Diego, California on January 3rd, 2023 when a semi-truck traveling south crossed over into my lane and collided with me head-on.

As a result of this collision, I suffered injuries including a broken leg, moderate concussion, whiplash and numerous other minor bruises and lacerations. My vehicle was totaled due to the severity of the crash.

My medical bills are currently over $40,000 and mounting quickly. I have lost over $10,000 in potential income at my job and this number continues to grow, as I am unable to return to work while I am still recovering from my injuries.

Furthermore, I have lost the value of my vehicle which amounts to approximately $50,000. Given these costs that I have incurred due to no fault of mine, I demand a settlement of $125,000 for damages including pain and suffering and loss of income caused by this accident.

Please understand that if you do not agree to provide me with an acceptable settlement amount by May 3rd 2023 then I will be forced to hire counsel who will proceed with legal action against your insured. To avoid any unnecessary legal costs or disputes we strongly suggest that you reach an agreement as soon as possible.

Thank you for your attention in this matter.

Sincerely, [Your Name]

2. Negotiate, Negotiate, Negotiate: As you’ve probably gathered by now, the first settlement offer made to you by an insurance company is usually low. With this in mind, you should start high with the amount in your demand letter, expecting them to come back with an offer much lower than the initial demand. It’s a good idea to go into the settlement negotiation with the expectation that there will be a few rounds of back and forth before settling on a figure that works for all parties involved.

3. Hire an Attorney: If you’ve written a strong demand letter and have gone through a few rounds of negotiations with the adjuster, it may be time to hire a lawyer to help you negotiate your car accident insurance settlement. Many people are afraid to reach out to a personal injury attorney for fears of high hourly fees, but in almost all cases car accident lawyers will work on contingency, meaning they don’t get paid unless/until you get paid, and they get paid as a percentage of your final settlement amount, so you’re interests are aligned to get you the biggest settlement possible.

Doing Your Own Research on Car Accident Injury Compensation

Many factors are taken into account when determining the amount of your settlement—including the severity and extent of your injuries and the kind of damage done to your vehicle. To ensure that you receive fair compensation, it is important to research average car accident injury settlements, as well as average pain & suffering multiples and other similar cases.

When researching an average car accident injury settlement award, it is important to look at both past cases with similar facts and circumstances as yours, as well as general averages for such claims. Every car accident claim is different, but there are some basic benchmarks that can be used to estimate an average amount of money awarded from a car accident case. Generally speaking, minor injuries such as whiplash will yield lower settlements than more severe injuries such as broken bones or traumatic brain injuries often seen in car accidents. Property damage also plays a role in determining the value of your claim: for example, if you have totaled your vehicle then you may be entitled to higher damages than if only minor repairs were necessary for repairs.

Finally, don’t overlook pain & suffering multiples. If the accident and ensuing injuries caused a decrease to your quality of life, you are entitled to fair compensation for your pain & suffering. This can range from not being able to play with your kids, pursue hobbies and social activities, or even lack of sleep. While pain & suffering is a very subjective number and will vary depending on the victim’s individual injuries and circumstances, not asking for enough for your pain & suffering in a car accident insurance settlement is a mistake made frequently, especially by people who haven’t hired an attorney. A good car accident lawyer will know what to include in a pain & suffering claim and usually won’t let the insurance adjuster sell you short in this regard.

As you can see, it’s important to look into “pain and suffering damages” when determining how much money to expect from an average car accident injury settlement. This is usually expressed as a multiple that takes into account both the financial impact (i.e., medical bills and lost wages due to time taken off work) as well as non-economic damages (like emotional trauma).

This number can range anywhere from 1x—5x depending on the circumstances surrounding your case. Multiples of 5 are rare, and typically reserved for life altering injuries (amputations, paralysis, permanent brain injuries, etc), but it’s not uncommon to see multiples of 3 for common car accident injuries such as whiplash, broken bones, and herniated disc injuries.

Another tool that might help you get started – we have developed a car accident settlement calculator that can be used to give you an idea how much your car accident claim is worth. Just enter numbers such as medical bills, loss of income, and pain & suffering, and it’ll give you an idea how much you could be owed in damages. Keep in mind this is a rough estimate, but can be a very helpful tool in getting a starting ballpark figure to work with.

Conclusion

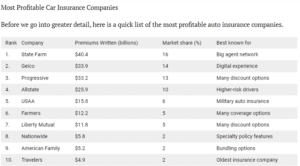

Auto insurance companies are among the most profitable businesses in the world – and for good reason. They take in billions of dollars per year in premiums, and the last thing they want to do is give that money to you.

Source: https://www.globalbankingandfinance.com/the-most-profitable-auto-insurance-companies-and-why/

By doing your research, writing a strong demand letter, and hiring an attorney when you feel you’re being treated unfairly, you can tilt the playing field in your favor and take your fair share of these premiums in the form of a car accident insurance settlement that leaves you financially whole.