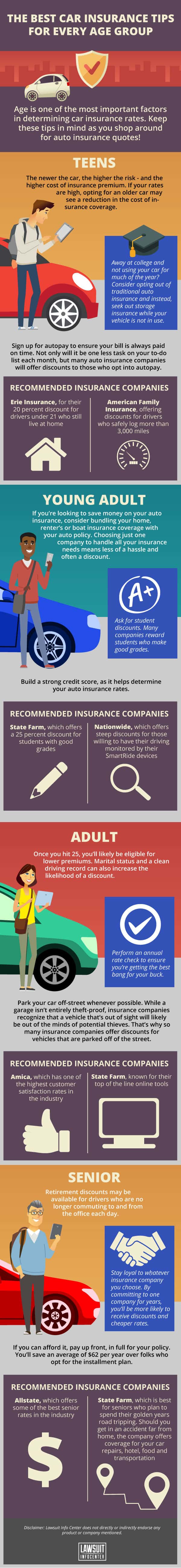

Age is one of the most important factors in determining car insurance rates. Keep these tips in mind as you shop around for auto insurance quotes!

Teen

- The newer the car, the higher the risk – and the higher cost of insurance premium. If your rates are high, opting for an older car may see a reduction in the cost of insurance coverage.

- Away at college and not using your car for much of the year? Consider opting out of traditional auto insurance and instead, seek out storage insurance while your vehicle is not in use.

- Sign up for autopay to ensure your bill is always paid on time. Not only will it be one less task on your to-do list each month, but many auto insurance companies will offer discounts to those who opt into autopay.

- Recommended insurance companies: Erie Insurance, for their 20 percent discount for drivers under 21 who still live at home, and American Family Insurance, offering discounts for drivers who safely log more than 3,000 miles per year.

Young Adult

- If you’re looking to save money on your auto insurance, consider bundling your home, renter’s or boat insurance coverage with your auto policy. Choosing just one company to handle all your insurance needs means less of a hassle and often a discount.

- Ask for student discounts. Many companies reward students who make good grades.

- Build a strong credit score, as it helps determine your auto insurance rates.

- Recommended insurance companies: State Farm, which offers a 25 percent discount for students with good grades, and Nationwide, which offers steep discounts for those willing to have their driving monitored by their SmartRide devices.

Adult

- Once you hit 25, you’ll likely be eligible for lower premiums. Marital status and a clean driving record can also increase the likelihood of a discount.

- Park your car off-street whenever possible. While a garage isn’t entirely theft-proof, insurance companies recognize that a vehicle that’s out of sight will likely be out of the minds of potential thieves. That’s why so many insurance companies offer discounts for vehicles that are parked off of the street.

- Perform an annual rate check to ensure you’re getting the best bang for your buck.

- Recommended insurance companies: Amica, which has one of the highest customer satisfaction rates in the industry, and State Farm, known for their top of the line online tools.

Senior

- Retirement discounts may be available for drivers who are no longer commuting to and from the office each day.

- Stay loyal to whatever insurance company you choose. By committing to one company for years, you’ll be more likely to receive discounts and cheaper rates.

- If you can afford it, pay up front, in full for your policy. You’ll save an average of $62 per year over folks who opt for the installment plan.

- Recommended insurance companies: Allstate, which offers some of the best senior rates in the industry, and State Farm, which is best for seniors who plan to spend their golden years road tripping. Should you get in an accident far from home, the company offers coverage for your car repairs, hotel, food and transportation.

Disclaimer: Lawsuit Info Center does not directly or indirectly endorse any product or company mentioned.